Whether you are a specialist or general insurer or MGA we understand that risks can be complex and accuracy is key. We work with you to identify your bottlenecks and increase your efficiency whilst maintaining your professionalism to unlock new areas of growth.

MGA Workflow

We model our software on industry standard practices followed by insurance companies and MGAs worldwide, but we understand that everyone works differently so of course we can customise the process to meet your needs.

System Modules

Distribution

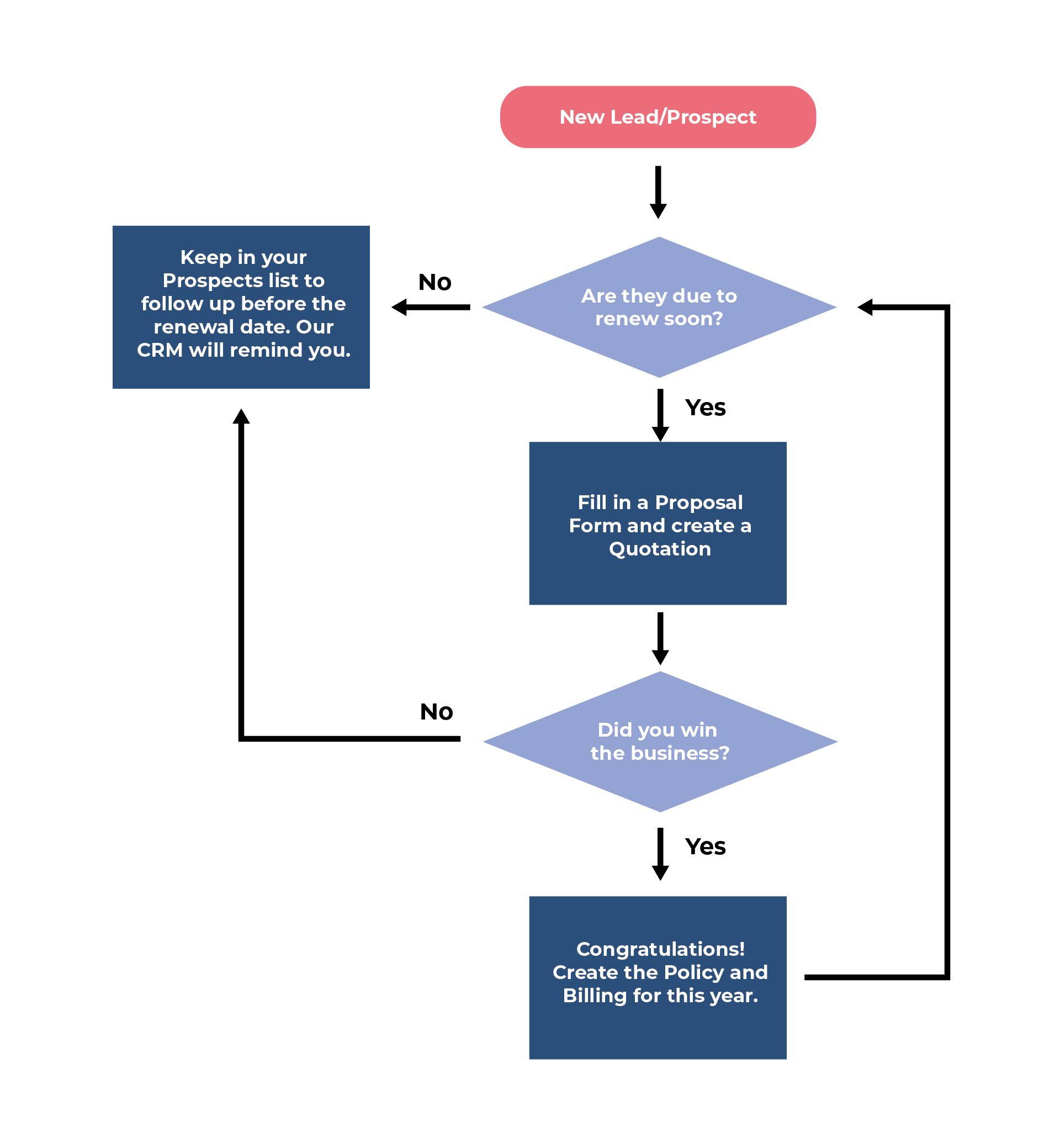

Win more business by never losing track of an enquiry or future prospect

CRM Workflow

Track and Manage Enquiries/Prospects

Our CRM module is designed for the unique practical needs of the insurance industry.

The process always loops back around at the renewal date so that no lead or past customer is lost forever – you always know when an account is renewing so you can try again next year.

You can review a list of prospects in the app and get a periodic email reminders to ensure your sales team don’t miss anything.

All the client data is stored and reused year to year, so everything is at your fingertips and you never have to ask the client the same questions again and again.

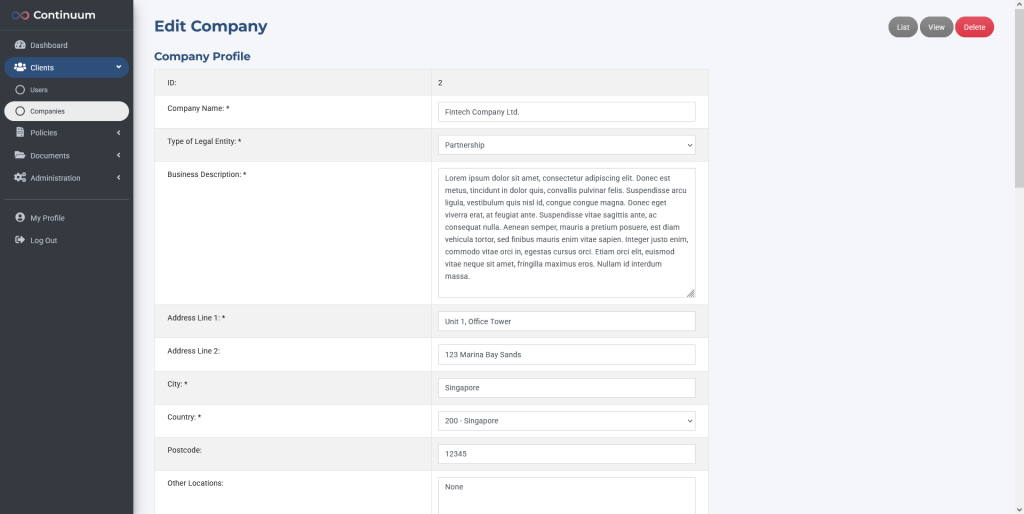

Manage Client & Enquiry Data

While it starts simple, keeping accurate records is at the heart of any system.

Log your client and enquiry data in the system, keep centralised records of everything from the basic company information to proposal forms for each enquiry. We customise the structure and fields to your specific needs.

You can either manage this data internally, or build a client portal to allow clients to input and update their data by themselves.

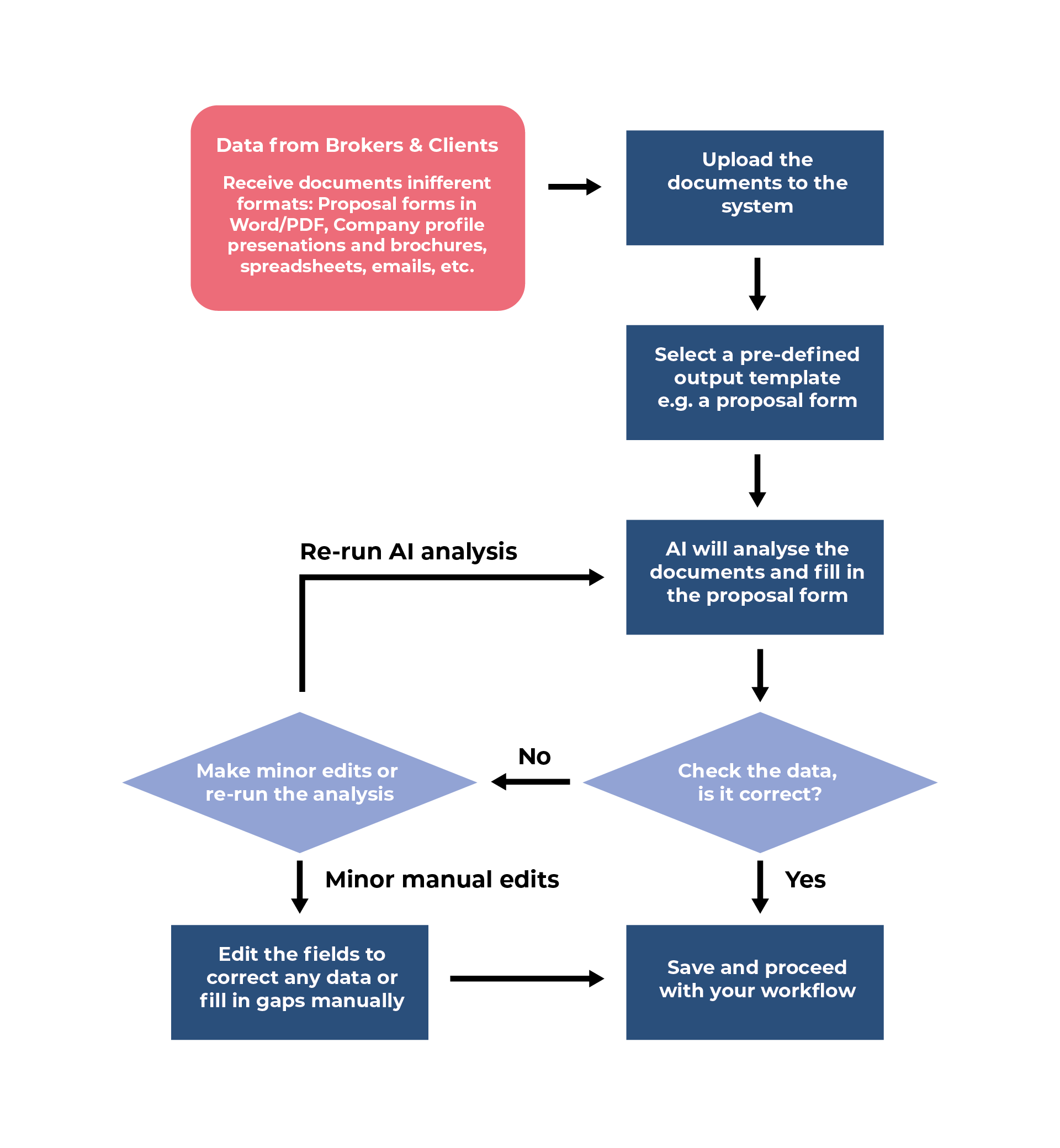

AI-Powered Data Processing

When your data comes from multiple sources it is time consuming to manually convert this into a standard format for you to use. e.g. if you have different brokers sending their own version of a proposal form, they all contain similar questions but you need to extract the data in a standard format to use.

Using AI we can upload the documents for it to read, and ask it to extract information to fill in pre-defined fields.

AI is not infallible and sometimes the data may not exist in the source documents, so there must still be human oversight to check and make modifications before saving the data.

We can use any AI model that supports attached documents such as ChatGPT and Google Gemini.

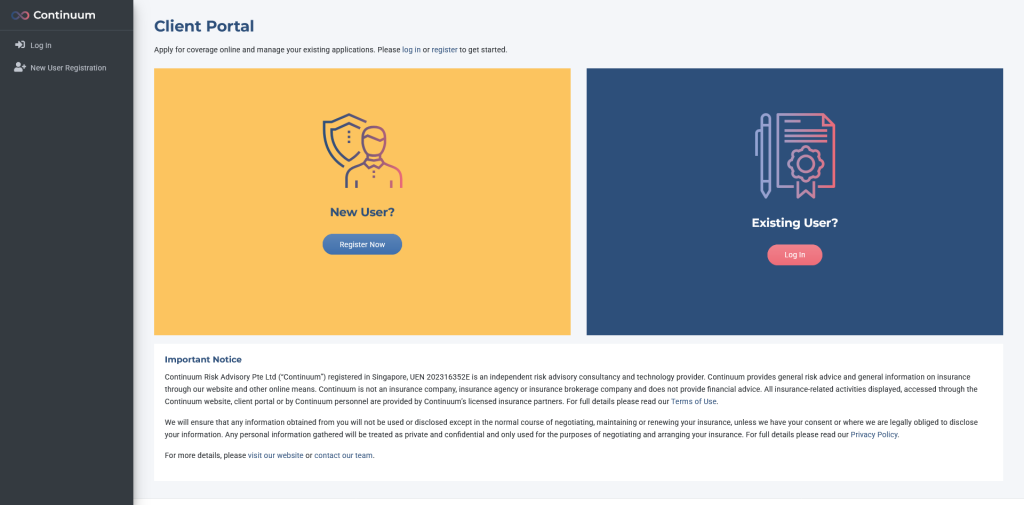

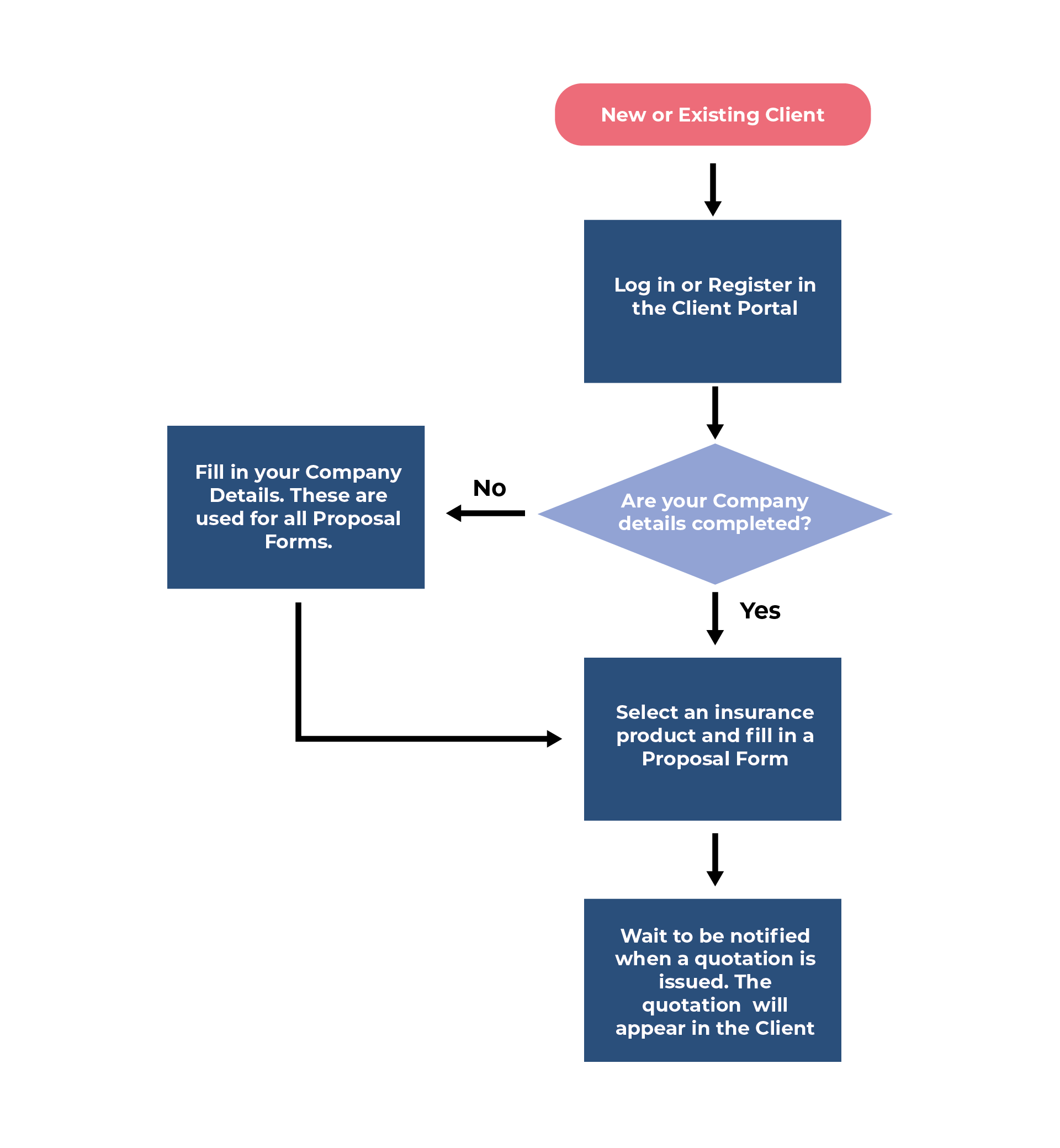

Broker Portal & Proposal Forms Workflow

Our Broker/Agent Portal and Proposal Forms module makes it easy for new and existing clients to submit the information required for you to provide them with an insurance quotation.

The client can log in and submit forms for new coverage or renewals. In the case of renewals the previous proposal form data can simply be updated and resubmitted so the client does not need to fill in everything again.

The client can return to the Client Portal to view and manage quotations, policies, billing, claims and other modules.

Broker/Agent Portal

With a broker/agent portal you can streamline your data collection processes and reduce errors. Instead of your team managing data input, you give your partners the tools to do it themselves. They can register their clients, fill in the personal details and proposal forms online for you to quote on.

The broker/agent portal can be expanded to provide functions to share files, manage policies and renewals, billing, claims and more all through one place. Your portal allows your broker and agent partners to manage multiple clients.

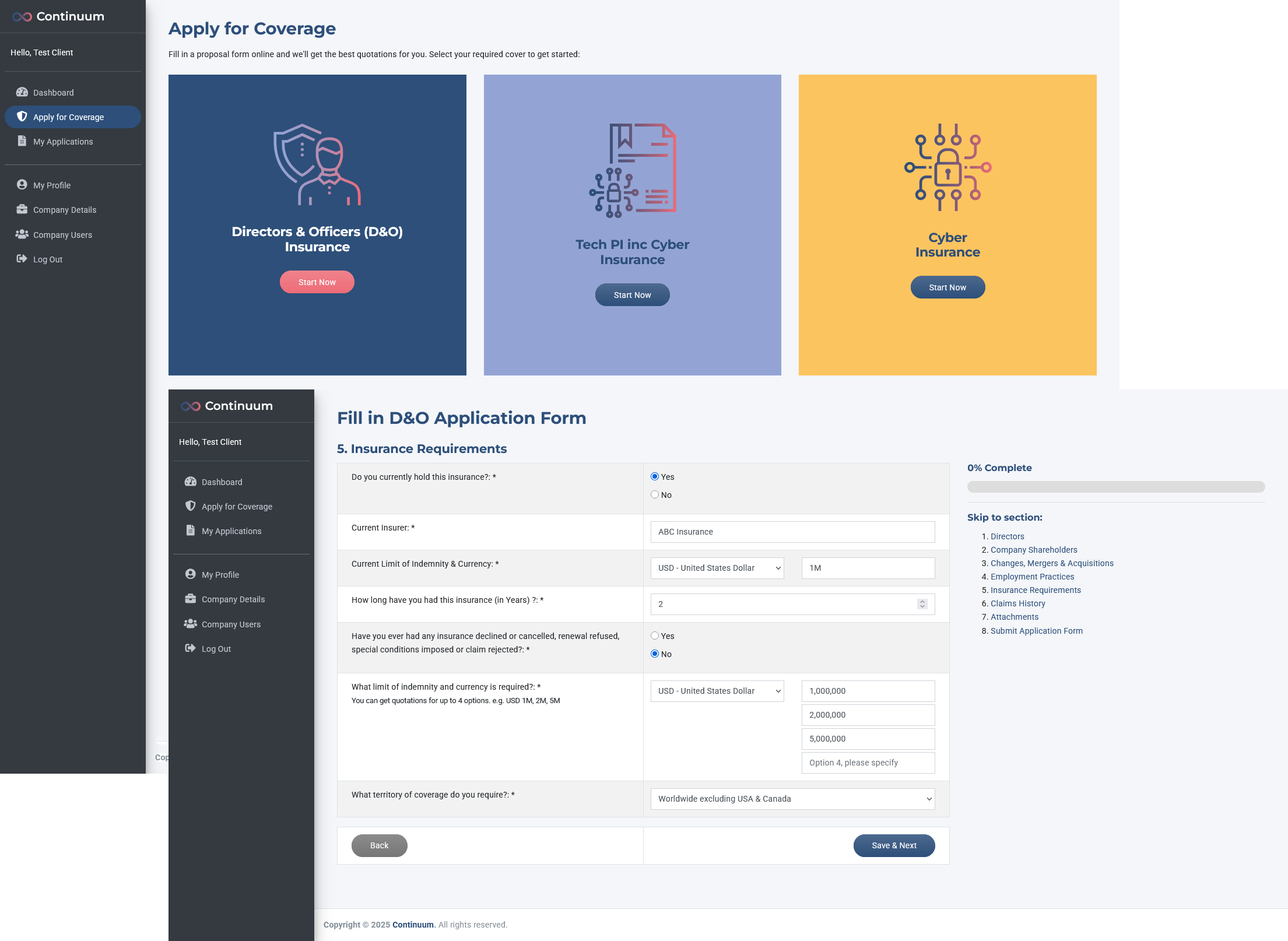

Proposal Forms

Enable brokers/agents to apply for coverage and fill in a proposal form from the portal on behalf of their clients. The system can handle both simple and complex forms tailored to your insurance products and requirements.

First they will select an insurance product in the portal. Next they follow the steps to fill in all the required data. Once completed, they can review and submit the form. The data is then sent to the insurer to obtain a quotation, or to your team to handle the quotation process.

System Modules

Underwriting

Efficiently manage the quotation process with your underwriting department

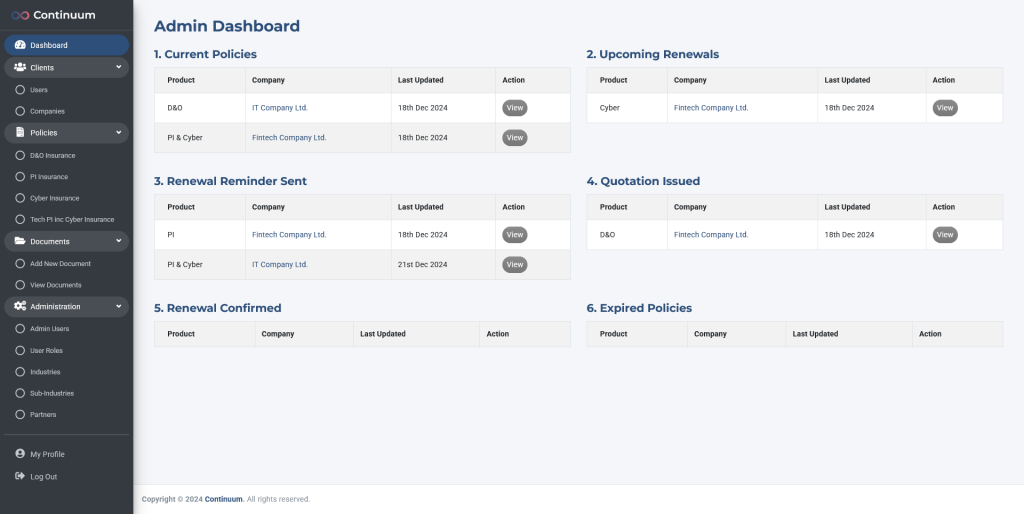

Track Enquiry & Quotation Progress

Your team has it’s own administrator portal to manage the data in the system. View clients, update enquiry statuses, issue documents and more.

Assign permissions to your team to manage their area such as sales, operations and accounting departments.

The admin portal can include all kinds of tools, custom reports, anything that makes your work easier.

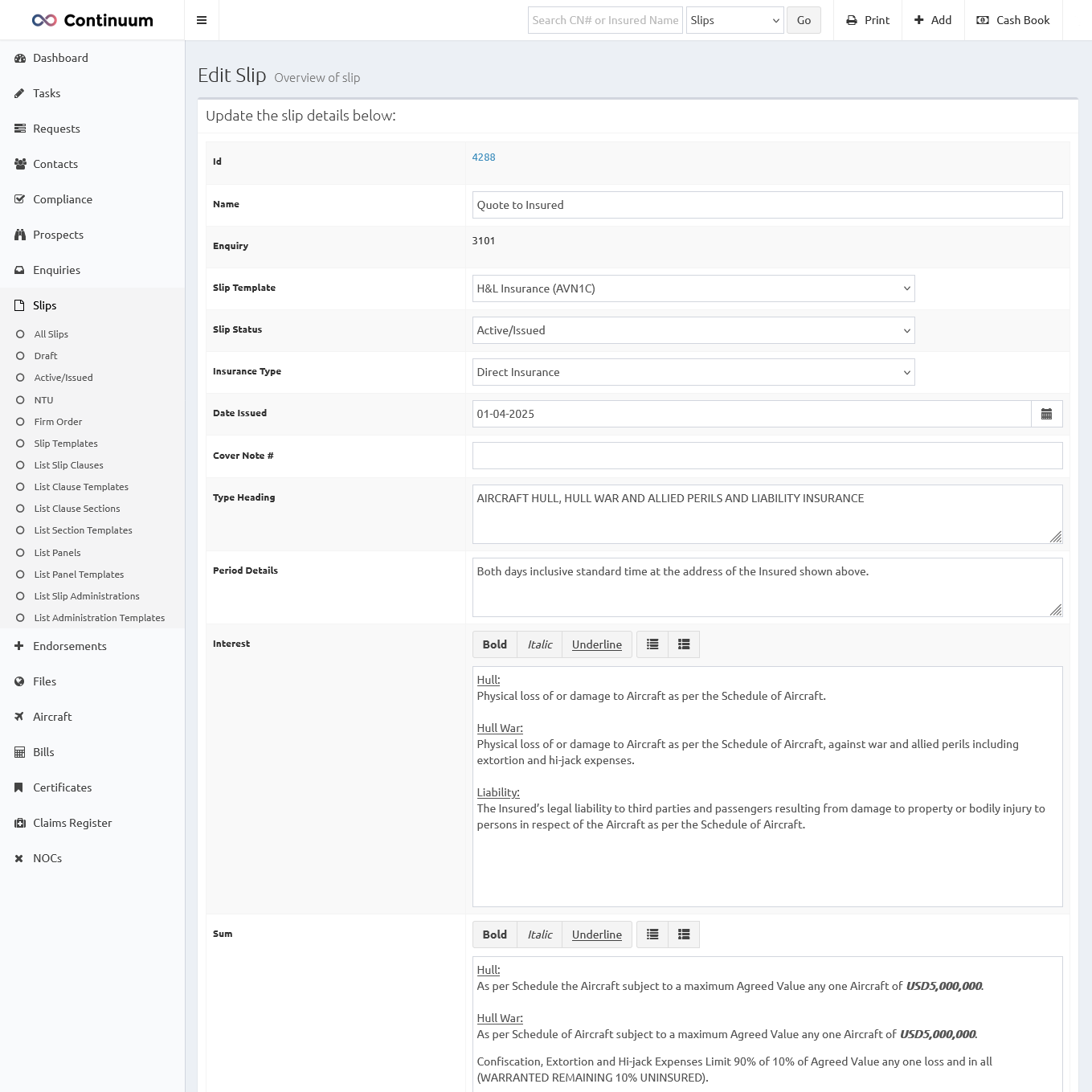

Quotations

Our system can enable your team to create complex quotations from templates, add standard clauses, and make updates based on feedback. We eliminate confusion over the latest wording as everyone can always see the latest version.

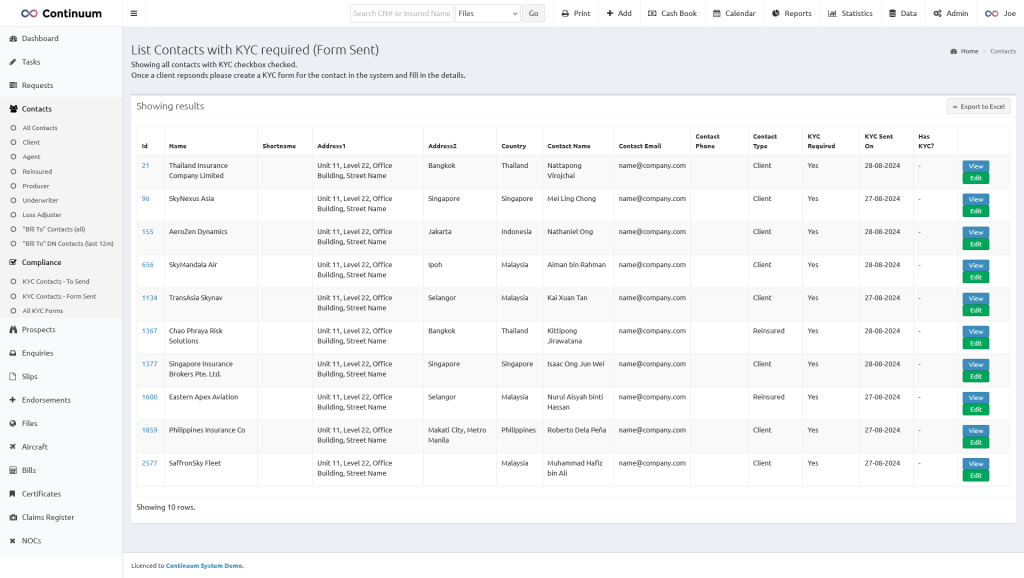

KYC/AML

Our system can enable your team to integrate your KYC/AML process allowing you to keep track of potential sanctioned risks and report to your capacity provider when required

System Modules

Administration

Process your customer policy documentation quickly and accurately

Document Generation

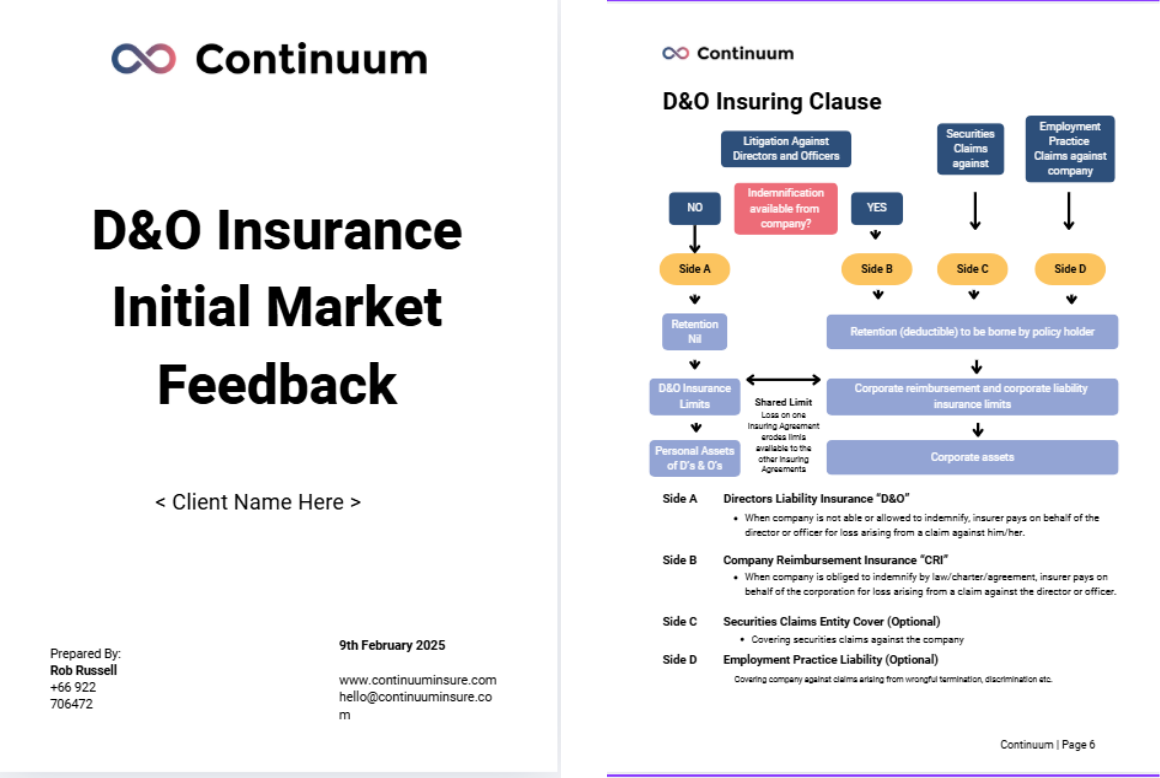

Generate quotations, quotation comparisons and benchmarking reports to better advise your clients.

Together we can design custom document templates that can incorporate graphics, charts and tables to make the information easy to understand. These templates are then populated with the client’s quotation or policy data to instantly customise them for each client.

The same approach is also used to generate client-friendly PDF documents for policies, certificates, endorsements, claims documentation, bills, tax invoices and more. Anything you would manually create and save as a PDF can be pre-determined and generated from the system.

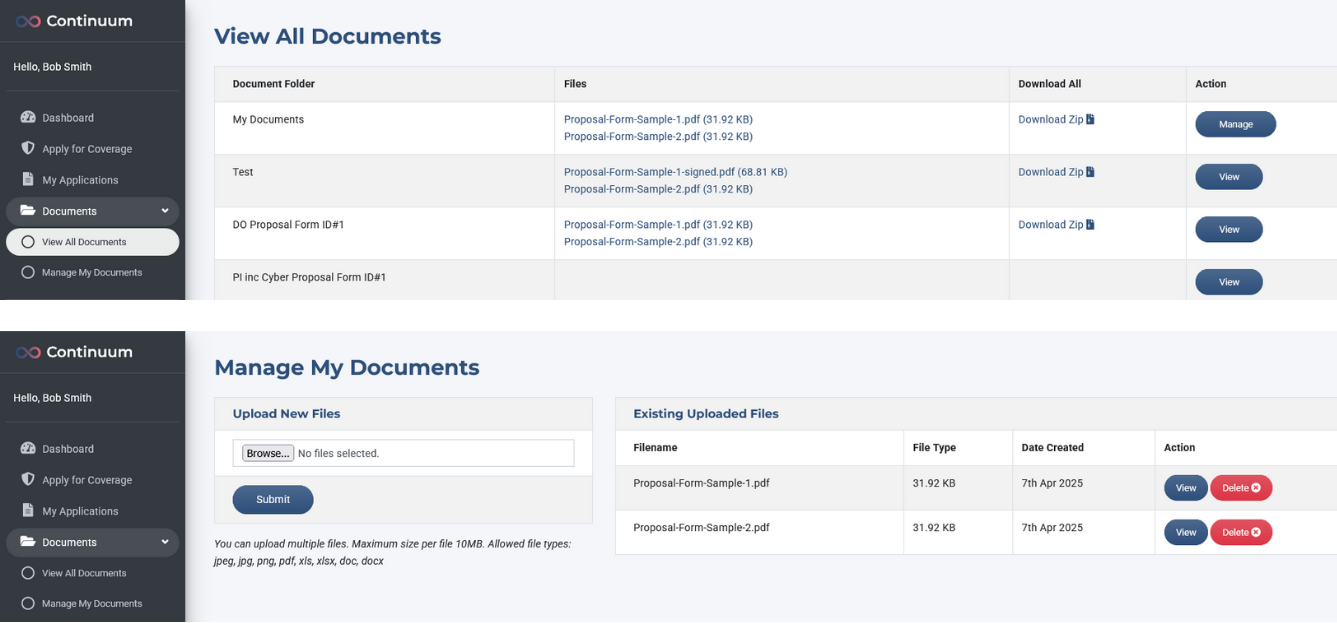

File Sharing

With a client portal you can share files with your clients through a web interface. Or you can send your generated documents manually by email.

You can also upload the client’s policy files, certificates, billing and other documents that they can access by themselves – so they don’t need to ask you every time. Your client can also upload files to share with you, such as a signed form or NDA.

Better efficiency

No need to email files back and forth.

Improved security

Share within the secure portal instead of emailing or transferring via third-party apps.

Centralised storage

Create a single source of truth to eliminate confusion over what is the latest version of a file and where it is stored.

Shared knowledge and Redundancy

Everyone in your team knows where to find the relevant files, so they can easily fill in when the person responsible for the account is unavailable.

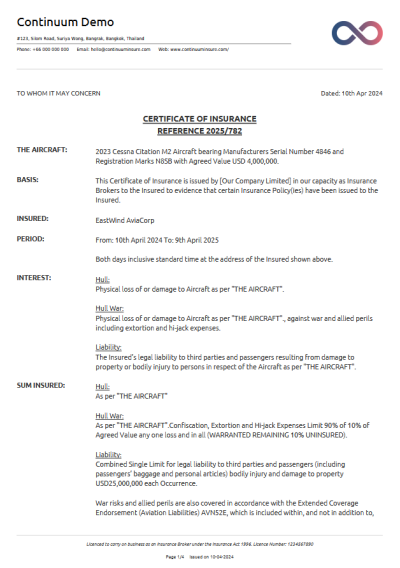

Certificates

Generate certificates from the system including all the relevant details of the client, underwriter, policy and insured interest.

Certificate PDF templates can be customised for specific purposes e.g. to comply with local regulations in different countries.

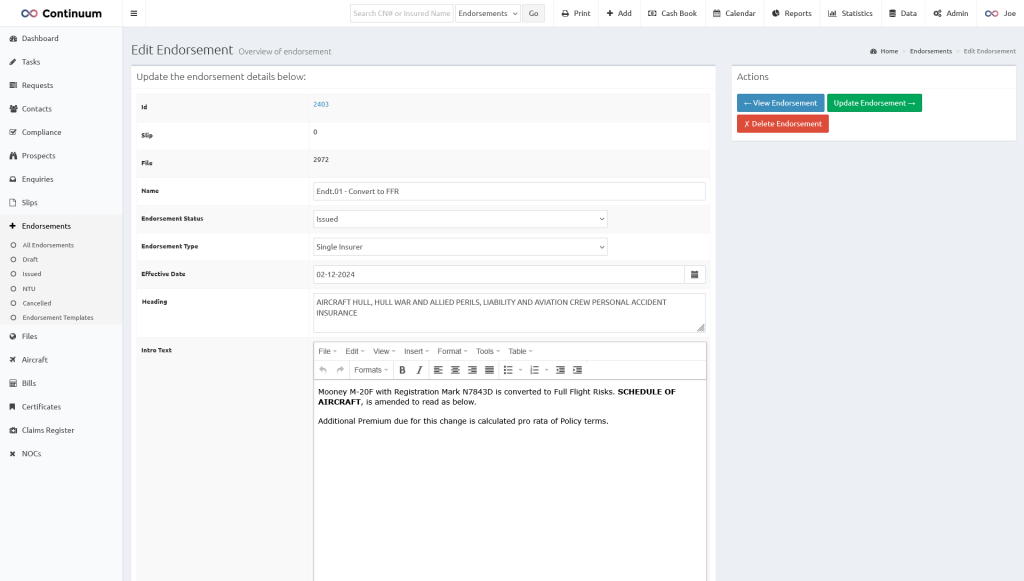

Endorsements

Record endorsements and amendments in the system. Create additional billing if applicable.

Fill in the details of your endorsement, use a template if needed, and once done generate a PDF to send to your client and underwriters.

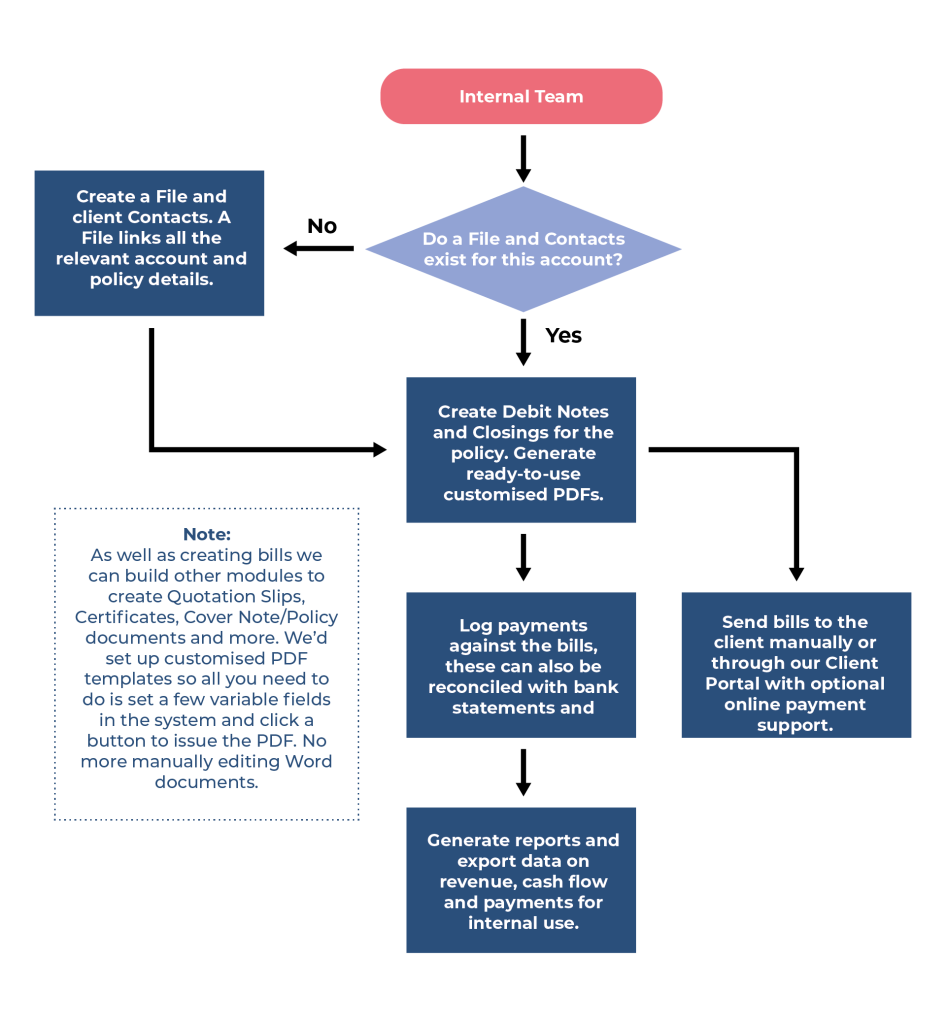

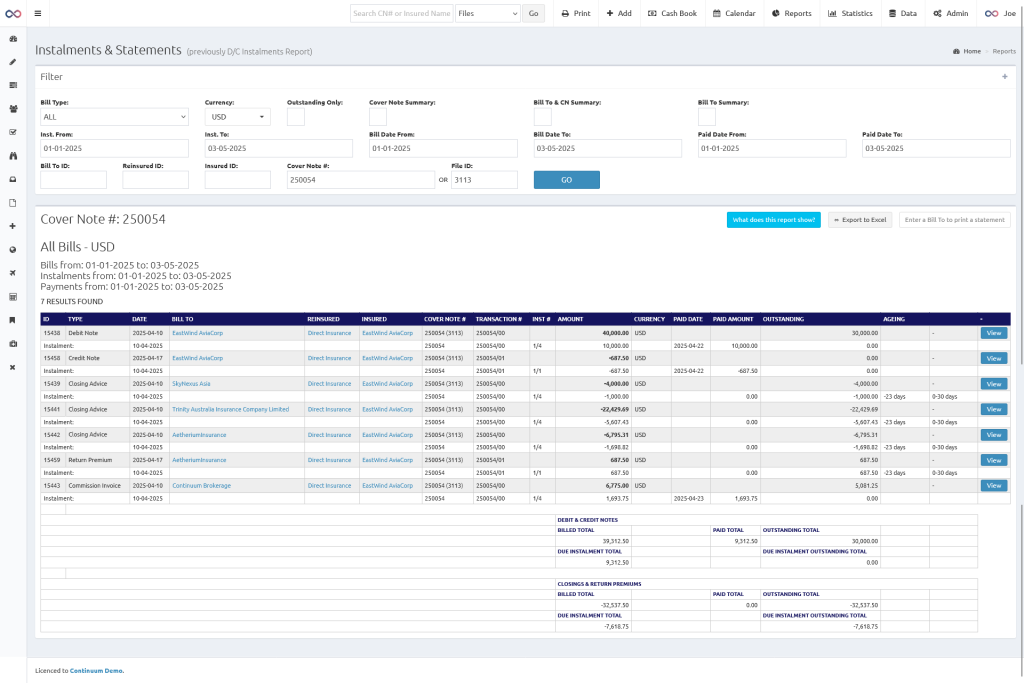

Billing Workflow

Our Billing module can be customised to handle complex cases including instalments, reinsurance, producer commissions, online payments, country-specific tax and billing requirements, and more.

When you fully embrace the system as a single source of truth we can generate accurate reports on revenue, cash flow and payments due to enhance the efficiency, accuracy and compliance of your accounting operations.

We can also offer functionality to import bank statements to reconcile accounts, and export bills to accounting platforms such as Xero or Quickbooks so you can use those platforms to handle further accounting and expenses.

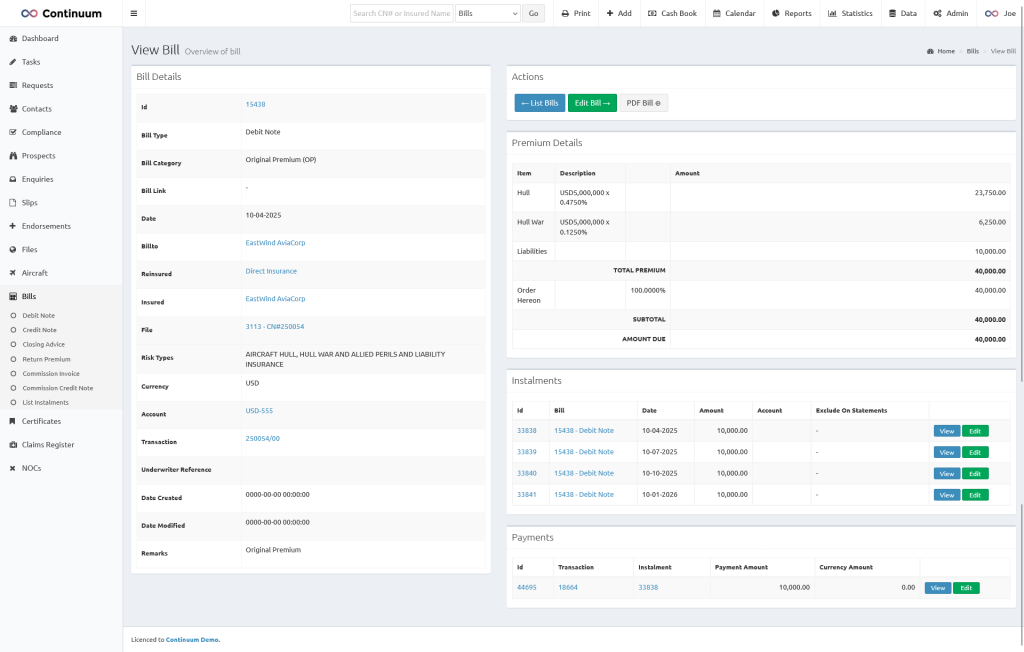

Billing

For each policy you issue all your bills in the system. Keep track of what your client is paying, what you need to pay underwriters, and what commission you are earning and the payment status for each. Optionally you can also handle payment instalments and multiple currencies.

Single source of truth

If the bills are accurate then everything from then on is also accurate, from quick reports to end of year accounts.

Shared knowledge and Redundancy

Multiple people in your team can issue bills in a consistent format, see the status of billing and payments.

Integrate with accounting software

Upload your bank statements to reconcile payments, and export data to accounting software.

Bespoke analysis & statistics

Run custom reports to interrogate your billing data.

System Modules

Reports & Analytics

Analyse your business data with custom reports

Reports & Statistics

Create reports for either individual accounts or all your billing for a set period. Use these figures in your cash flow and accounting purposes with confidence that they are correct because all the data came from the bills that were issued. No more having to ask your accounting team to manually calculate and create reports.

Example shows a statement for a single account.

System Modules

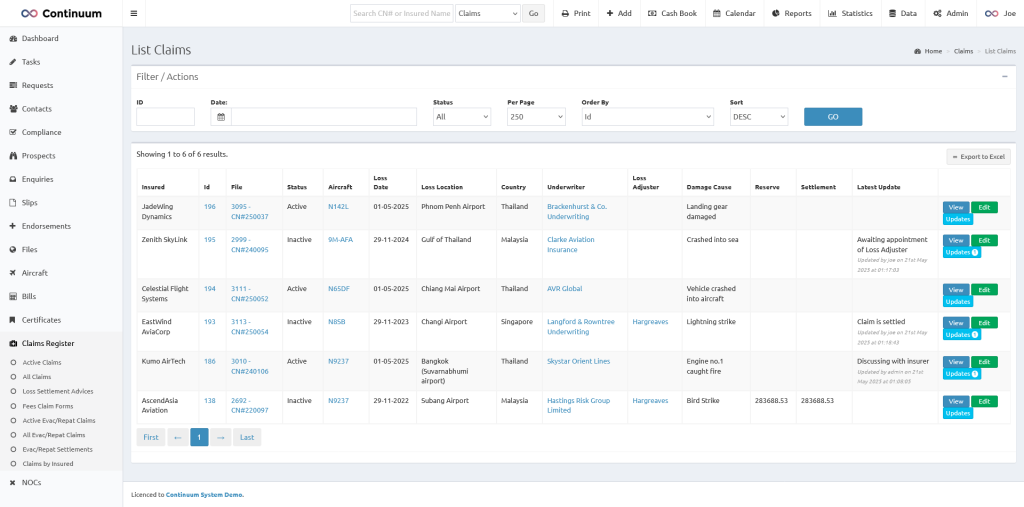

Claims

Keep track of claims and settlements

Claims

Keep a record of claims in the system. This can be tailored depending how involved you are in the claims process – either just handing over to the insurer, keeping updates on the process, or a more hands-on approach,

If you handle a lot of claims you could connect this with claims submission through your website, or allow your clients to submit, manage and view every step of the claims process through a client portal.