Bitcoin is no longer a fringe asset, it’s becoming a calculated treasury move.

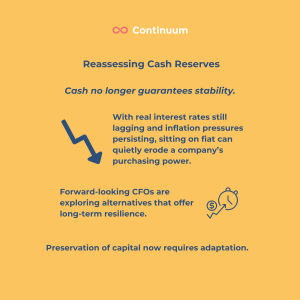

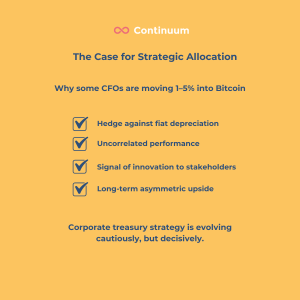

From inflation pressures to growing institutional adoption, CFOs are rethinking the role of cash and exploring small but strategic allocations into Bitcoin.

But adding BTC to the balance sheet isn’t without complexity. Custody, volatility, and governance concerns demand a clear risk strategy.

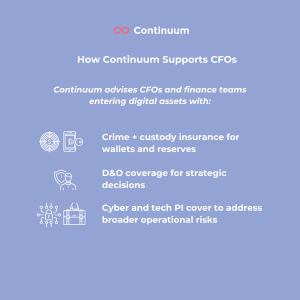

At Continuum, we work with finance leaders to ensure their treasury innovation is protected and defensible.

🔍 Swipe through to understand:

• Why CFOs are allocating 1–5% to BTC

• The risks behind the trend

• How insurance and risk advisory de-risk the journey